UMD - SPS

Simple Payment Service

|

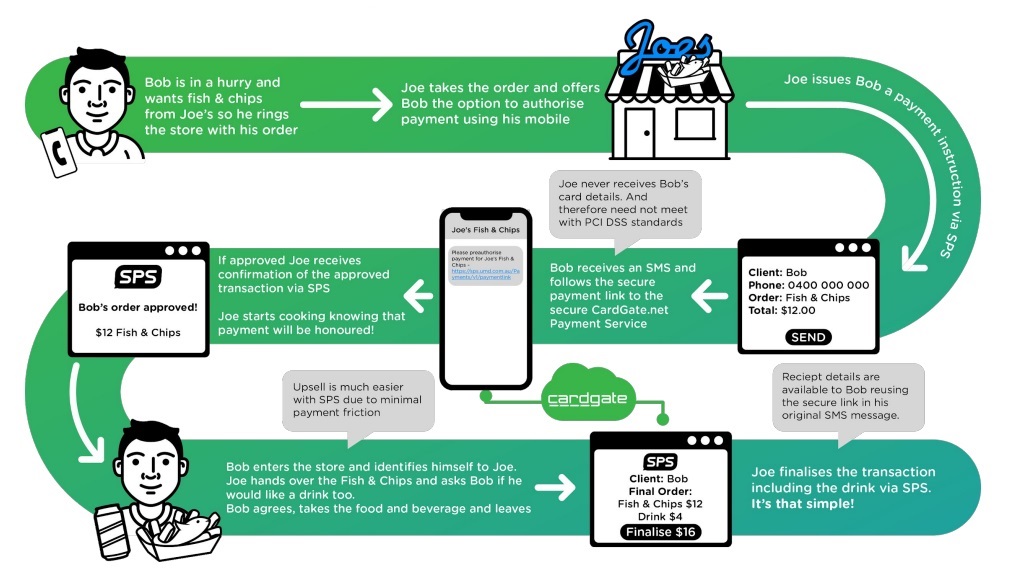

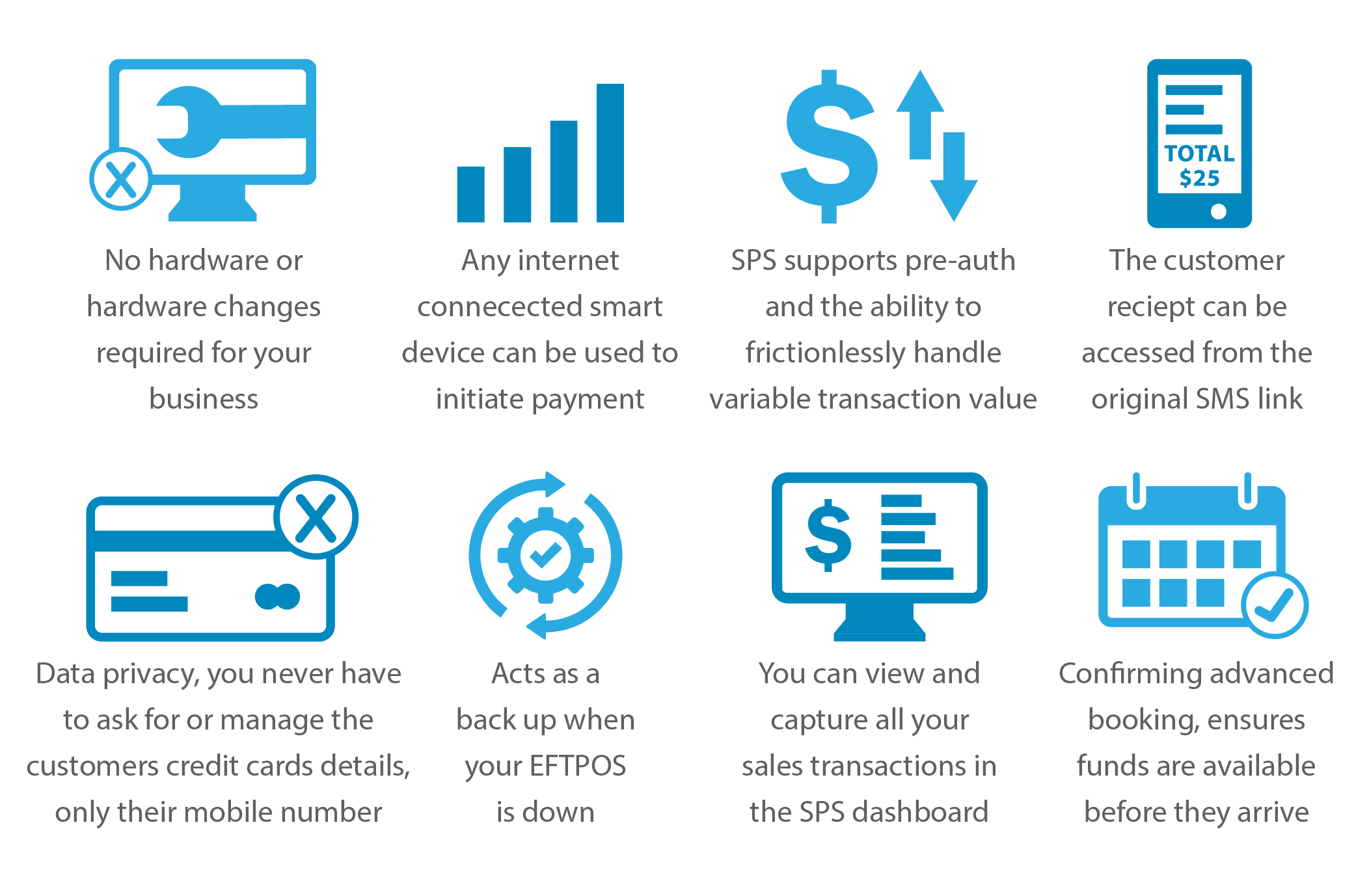

What is UMD SPS?The Simple Payment Service (‘SPS’) is a payment platform specifically designed for conducting credit card transactions in a mobile friendly way. Any Internet connected device, such as a smartphone or web browser, can be used to initiate a credit card payment request by sending a SMS to the Credit Card holder. Furthermore, SPS supports both direct and pre-authorised payments. With pre-authorised payments, the transaction may also be closed at a different value. A simple example being: Send a SPS payment request (SMS) to both confirm a booking and pre-authorise the payment. Then close the transaction, at the end of the service, with the actual value (eg. service fee plus parts) without further involvement from the Card Holder. SPS requires minimal infrastructure to operate:

|

|---|

| ||

Features and BenefitsFor Merchant:

For Credit Card Holder:

Operating Modes

No Special Payment Terminal is Required

Who Would Use SPS?

Minimise Risk

Purpose

Technology

Electronic Voucher Terminal

| ||

| Part Number | Model Number | Description | RRP Inc GST |

T % |

|---|---|---|---|---|

| [A] Merchant System Configuration and Setup | ||||

| AP-BOS-SPS-101-CPE | BOS/Simple Payment Service - Configuration & Setup | $429.00 | P | |

| [B] Merchant Transaction Fees | ||||

| SP-BOS-SPS-101-TPM | BOS/Simple Payment Service - Transaction per Payment (billed monthly) | $0.55 | S | |

| Minimum charge: 40 transactions per month. Transactions can come from any BOS or SPS functions. | ||||

| [C] SMS Charge Above Allowance | ||||

| SV-UWS-SMS-101-TMM | UMD Web Services - SMS transactions per month | $0.17 | T | |

| Allowance = 1.2 x Number of Payments Processed | ||||

| [D] Notes | ||||

| Fee covers, software as a service, hosting, SPS credit card transaction processing and SMS | ||||

| Services invoice in arrears. | ||||